Not known Details About Cdjr Walla Walla

Table of ContentsThe Facts About Cdjr Walla Walla Revealed9 Easy Facts About Cdjr Walla Walla DescribedSome Of Cdjr Walla WallaSome Known Facts About Cdjr Walla Walla.3 Simple Techniques For Cdjr Walla WallaThe Main Principles Of Cdjr Walla Walla

Right here's how to acquire a vehicle without getting over your head in debt or paying even more than you have to. "The single best guidance I can provide to people is to get preapproved for a vehicle finance from your bank, a credit rating union or an on-line lender," says Philip Reed.

He likewise worked undercover at an auto dealership to discover the tricks of the service when he helped the car-buying site . So Reed is mosting likely to draw back the drape on the car-buying video game. For one point, he says, obtaining a finance from a lending institution outside the vehicle dealership motivates buyers to assume about a sixty-four-thousand-dollar question.

All about Cdjr Walla Walla

He claims, the dealership could not inform you that and supply you a 9% price. Reed states having that preapproval can be a valuable card to have in your hand in the car-buying video game.

"The preapproval will function as a bargaining chip," he says. "If you're preapproved at 4.5%, the dealership claims, 'Hey, you recognize, I can get you 3.5. Would you be intrigued?' And it's a good concept to take it, but make certain all of the terms, implying the down settlement and the length of the car loan, continue to be the very same." One word of caution regarding lending institutions: Van Alst claims there are lots of dubious financing attire running online.

What Does Cdjr Walla Walla Do?

Reed says do not answer those questions! That makes the video game as well difficult, and you're betting pros. If you work out an actually excellent purchase cost on the auto, they could boost the passion price to make extra cash on you that method or lowball you on your trade-in. They can juggle all those variables in their head simultaneously.

A Biased View of Cdjr Walla Walla

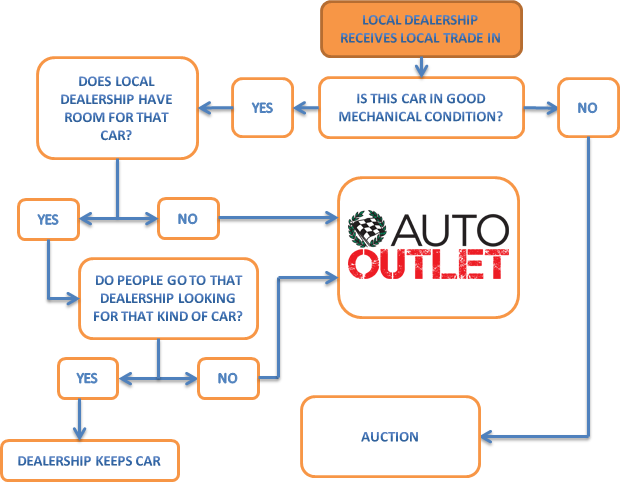

Keep it easy. One point each time. When you clear up on a cost, then you can speak about a trade-in if you have one. But Reed and Van Alst claim to do your research there also. A little research online can inform you what your profession deserves in ball park terms.

Dealers make a whole lot of cash on this things. He and Reed claim a great method, particularly with a brand-new auto, is to simply state no to everything.

Some Known Facts About Cdjr Walla Walla.

The money person may try to inform you, "It's just a bit more money per month." That cash includes up. "Concerning the prolonged factory service warranty, you can always buy it later," claims Reed. "So if you're getting a brand-new automobile, you can acquire it in 3 years from now, prior to it heads out of warranty." Then, if you want the extended warranty, he says, you must call numerous car dealerships and request for the most effective rate each can use.

And that's "a really unsafe trend," claims Reed. We have an entire storyregarding why that holds true. Yet in other words, a seven-year car loan will certainly indicate lower regular monthly settlements than a five-year car loan. It will certainly likewise imply paying a whole lot more money in passion. Reed states seven-year finances commonly have higher rate of interest than five-year finances.

"Most individuals don't even realize this, and they don't understand why it's dangerous," states Reed. Reed says that if you want to offer your car you decide you can't manage it, or possibly you have another youngster and require a minivan rather with a seven-year loan you are far more likely to be stuck still owing greater than the automobile is worth.

Cdjr Walla Walla for Dummies

Reed states a five-year loan make feeling for new automobiles because "that's been the conventional means it's kind of a sweet place. You recognize the vehicle will still be in good condition.